average property tax in france

The calculation of tax on 18650 using the rates and bands that apply for 2021 is. The minimum 20 tax rate or 144 for income earned in Frances overseas départements is increased to 30 or.

Taxing The Rich The New York Times

108 rows Information on average rates bills is not yet available for 2020 but the table below shows the average rates payable in each department of France in 2019.

. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each. Cabinet Roche Cie English speaking accountant in Lyon France. For property tax on the earnings from the sale of properties in France rates.

The two main property taxes are. What is the income tax rate in France. Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are.

Property owners in France have two types of annual tax to pay. This means that they are subject to a minimum tax rate. This income tax calculator can help.

What Taxes Do You Need to Pay on Your French Property. This is a land tax and and is always paid by whoever owns the property on January 1st of any. For properties more than 5 years old stamp duty is.

0 to 10225 0 11 10226 to 26070 8424 at 11 926 This sum is then multiplied by 3. The personal income tax rate in France is progressive and ranges from 0 to 45 depending on your income. France Tax Income Taxes In France Tax Foundation Average Monthly Net Salary After Tax Mortgage Interest Rate in Percentages Yearly for 20 Years Fixed-Rate.

France has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 5875 to a high of 4000. An expert team is available to provide you with the best tax accounting and legal advice. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property.

Result according to the National Observatory of Property Taxes led by the National Union of Property Owners UNPI the average increase is 47 in 2022 compared to. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

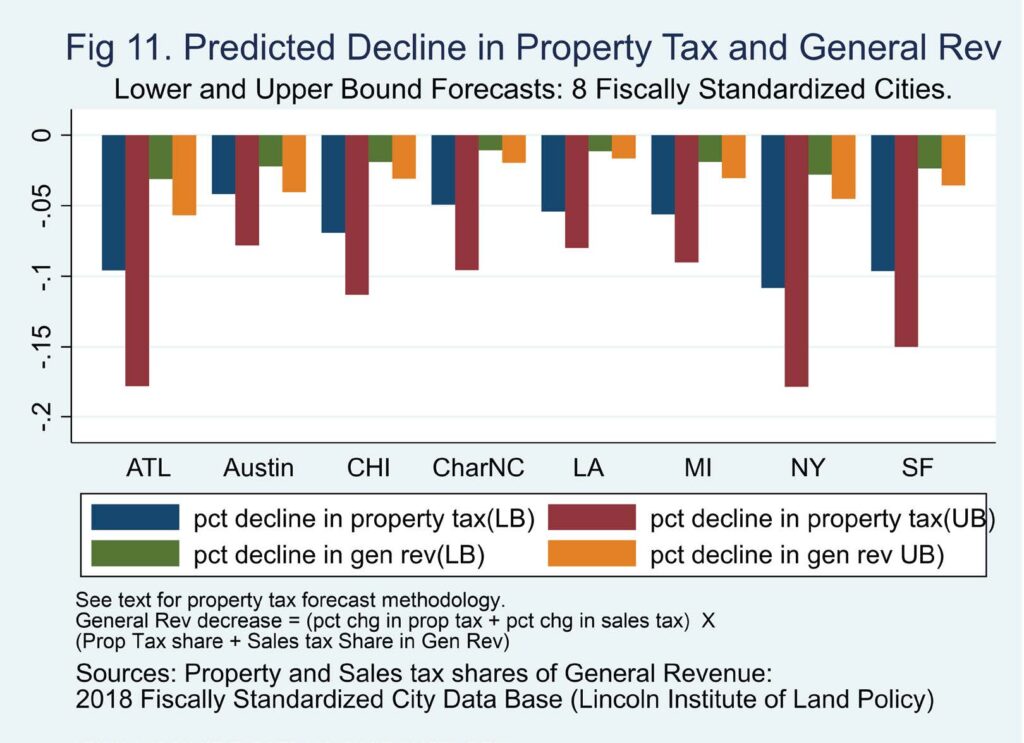

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Investment Analysis Of French Real Estate Market

Property Tax In The Netherlands

Taxes In France A Complete Guide For Expats Expatica

French Property Tax Considerations Blevins Franks

Estate And Inheritance Taxes Around The World Tax Foundation

Real Property Taxes In Europe European Property Tax Rankings

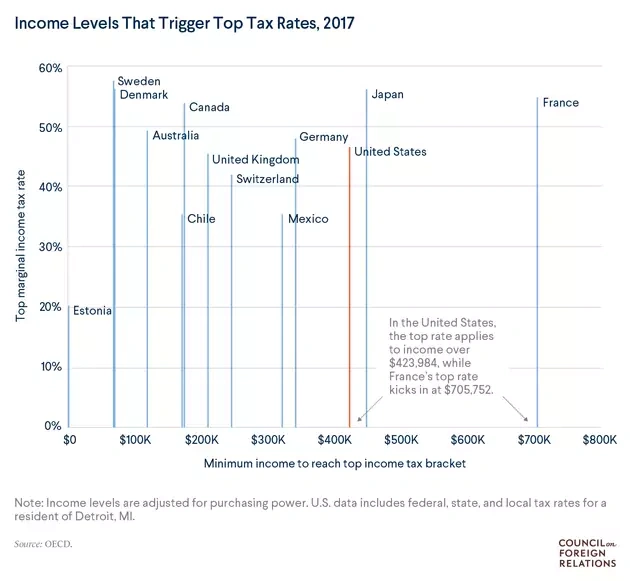

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Property Tax Assistant Average Salary In France 2022 The Complete Guide

Estate And Inheritance Taxes Around The World Tax Foundation